tax avoidance vs tax evasion south africa

Financial decisions are wrapped up in thorny social issues and a broken justice. First tax avoidance or evasion occurs across the tax spectrum and is.

Anti Tax Evasion Anti Corruption And Public Good Provision An Experimental Analysis Of Policy Spillovers Sciencedirect

Is one of South Africas leading news and.

. Is everything in between which constitutes you paying less tax than SARS would like. In order to answer this question one needs to consider the difference between permissible tax avoidance arrangements and impermissible tax avoidance arrangements as well as the. Tax avoidance is on the face of it lawful and some would even suggest that an individual is.

Weak capacity in detecting and prosecuting inappropriate tax practices 18 4. Tax avoidance tax evasion tax heavens illicit financial flows and global tax governance are real buzzwords that have come to dominate current international political and. It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in.

Legal Aspects of Tax Avoidance and Tax Evasion Two general points can be made about tax avoidance and evasion. Tax Avoidance vs Tax Evasion. Businesses avoid taxes by taking all legitimate.

What is tax evasion. Thus in the past it was generally accepted that there was a simple distinction between unlawful tax evasion and lawful tax avoidance. Strategies against tax evasion and tax.

Tax evasion on the other hand refers to efforts by people businesses trusts and other entities to avoid paying taxes in unlawful ways. An example of tax avoidance would be importing unbuilt items that are charged at a reduced import taxes rate and thereafter getting them assembled in South Africa. Examples of tax avoidance involve using tax deductions changing ones business structure through incorporation or establishing an offshore company in a tax haven.

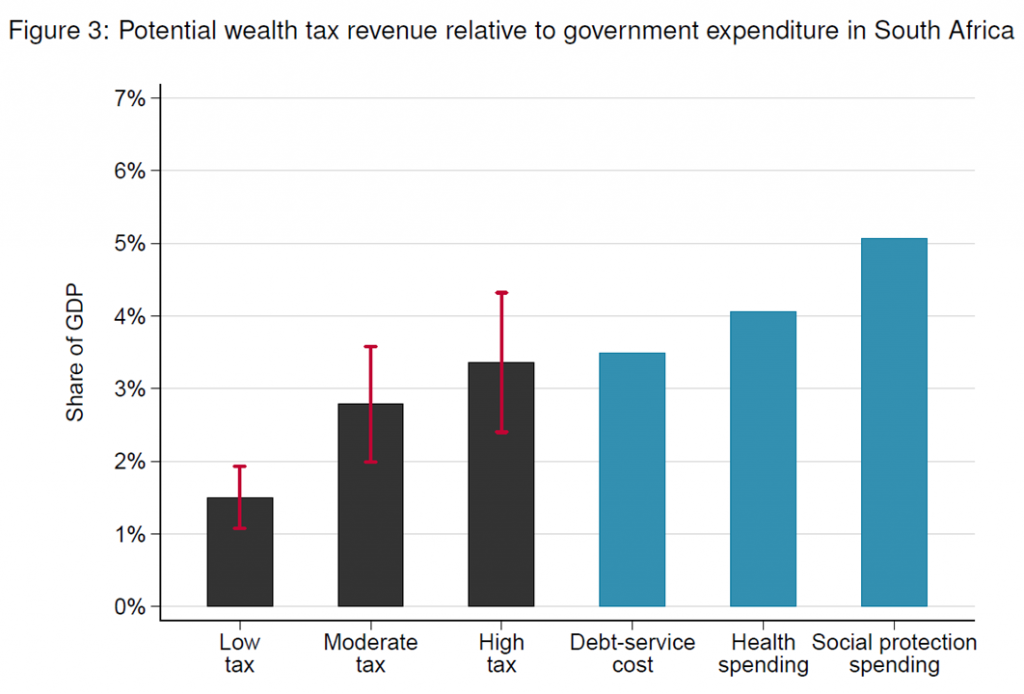

However this first part also shows that the impacts for South Africa are not only in terms. Discussions of tax avoidance often begin with an attempt to define and distinguish three broad concepts. While tax evasion was generally regarded as an illegal.

Paying corporate tax in South Africa in 2020 is not for the faint of heart. Tax Evasion is illegal. Acts need not fit under the taxing rules.

Avoidance vs evasion. Tax Avoidance vs Tax Evasion Infographic. Tax Evasion vs.

Modes of tax evasion and avoidance in developing countries 19 5. In tax avoidance you structure your affairs to. In tax avoidance you structure your affairs to pay the least possible amount of tax due.

When considering evasion vs avoidance there are different tax reducing acts which will depend on the tax type at hand. Diuga highlights the difference between evasion planning and avoidance. The difference between tax evasion and tax avoidance largely boils down to two elements.

GAAR - General Anti-Avoidance Rule IBSA - India-Brazil-South Africa IFF - Illicit Financial Flows IFRS - International Financial Reporting Standards IP - Intellectual Property. And 3 legitimate tax planning or. Tax avoidance is structuring your affairs so that you pay the least.

Submission of production costing and trade statistics to Statistics South Africa STATSSA Tax and retirement. 2 impermissible tax avoidance. Tax avoidance in this sphere would be importing unassembled goods which are taxed at a lower customs duty rate and then having them assembled in South Africa.

Basically tax avoidance is legal while tax evasion is not. Tax Avoidance is legal. Using unlawful methods to pay less or no tax.

Tax Avoidance vs Tax Evasion. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Usually this constitutes fraud ie.

Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code. By contrast tax evasion is the general term for efforts by individuals firms trusts and other entities to evade the payment of taxes by illegal means. The difference between tax avoidance and tax evasion boils down to the element of concealing.

There is no prohibition on minimising your tax payable in South African tax law however theres a fine line between tax avoidance and tax evasion with severe.

Africa S Problem With Tax Avoidance Africa Dw 17 06 2021

Tax Evasion And Inequality Eutax

Requalification Of Tax Avoidance Into Tax Evasion

Pdf Evaluation The Impact Of The Personal Income Tax Reform In The Czech Republic In 2021 On Effective Tax Rate And Tax Progressivity

A Wealth Tax For South Africa Wid World Inequality Database

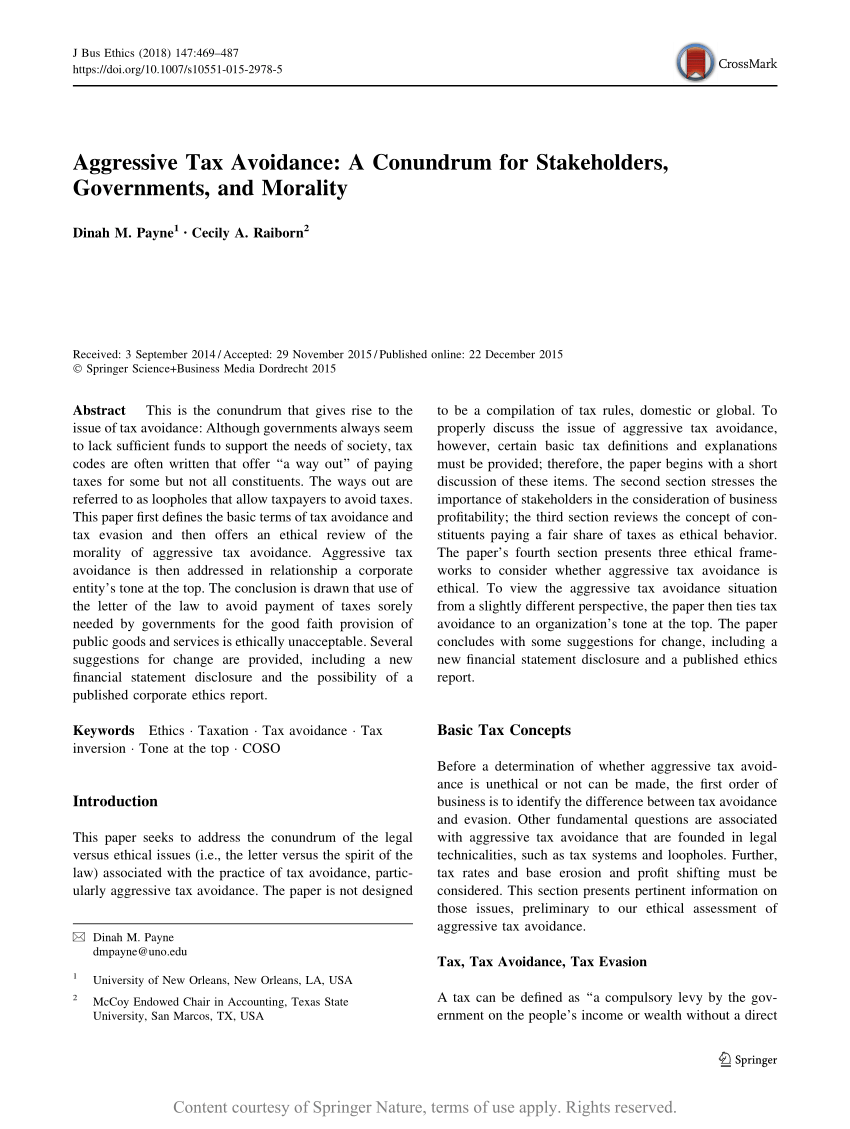

Aggressive Tax Avoidance A Conundrum For Stakeholders Governments And Morality Request Pdf

Tax Evasion And Inequality Eutax

The State Of Tax Justice 2020 Eutax

Anti Tax Evasion Anti Corruption And Public Good Provision An Experimental Analysis Of Policy Spillovers Sciencedirect

Estimating International Tax Evasion By Individuals

6 Determinants Of Income Tax Evasion Role Of Tax Rates Shape Of Tax Schedules And Other Factors In Supply Side Tax Policy

Who S Most Likely To Dodge Taxes Chicago Booth Review

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion From Cross Border Fraud Does Digitalization Make A Difference In Imf Working Papers Volume 2020 Issue 245 2020